The Chicago teachers’ strike is troubling on several fronts. Foremost is the fact that an otherwise well-paid group of teachers would ever consider striking on the first day of school at a time when folks in Chicago and across the country are trying to deal with extreme financial issues. The terrible inconvenience to parents of trying to find care for their children plus losing days at work makes the families’ situation much worse. In addition it appears that Chicago children are suffering from poor scholastic performance – losing valuable days while teachers dance in the street is tragic.

This lawsuit was the fantasy of a lawyer in Ashville, Pickaway County, Ohio. He alleged that my law office was operating a Racketeering conspiracy, had stolen money from my clients, (note that their debts far exceeded their assets) committed malpractice, fraud and he might have alleged that I caused the Civil War. (Ha!) [continue reading…]

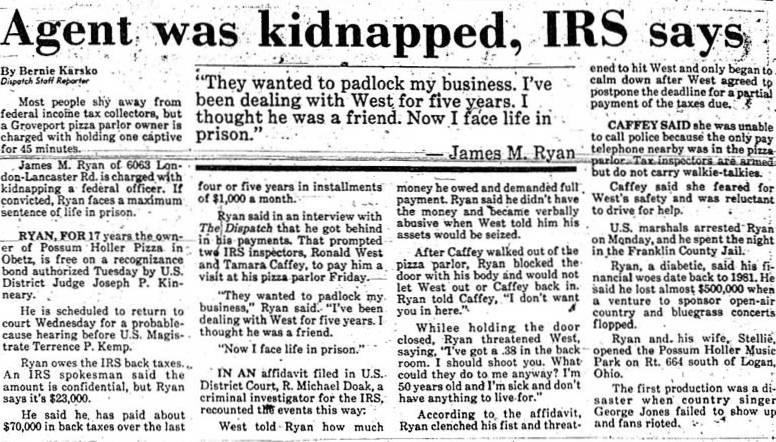

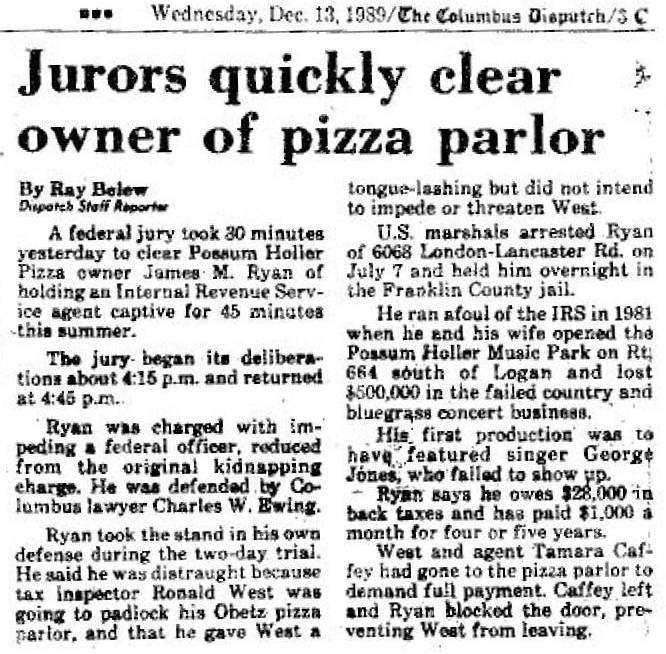

A client of mine who I counseled regarding some financial difficulties ran afoul of the IRS. He was arrested and charged with kidnapping an IRS official.

I tried to get a criminal attorney for him, but was unsuccessful. He requested that I represent him despite the fact that I was not a criminal attorney. The results were dramatic and emphatic. The trial prosecutor advised me on the way out the door that “…you do not know who you are messing with.” The same federal prosecutor who prosecuted me was the lead attorney on this case

There were other significant civil contests with the IRS and the Justice Department on behalf of clients which were resolved in my client’s favor. Again with the grumblings such as I did not know who I was messing with.

In the ordinary course of representation of dozens of farmer clients in the bankruptcy courts, I had many occasions to be opposite the Farmers Home Administration who is represented by the Department of Justice through the U.S. Attorney’s office. While all my representation was entirely within the confines of the law as written as well as intended, several cases were hotly contested. In the process on several occasions I was advised that I “carried things too far”. I believed that farmers had been trapped by government programs and suggestions in the 1970’s to increase their operations because it was favorable to international trade. Then there were competing national strategies, one of which was to boycott grain trade with some nations. These strategies resulted in drastically lowered grain prices which plummeted many farmers into insolvency. Many members of the bureaucracy, the Justice Department and some courts felt that these farmers were simply poor managers. Of course some were but most were very good farmers who were trapped. The laws were written as a form of social welfare legislation and as such many protections were built into the law. My main strategy was to ensure that these laws were followed. The results were that many of my clients were unable to pay FmHA yet the law allowed them to continue to operate. I won several cases which set precedent in the area of farmer bankruptcy law. One of which was extremely costly to the Department of Justice. (I estimate millions of dollars per year) While this is a large amount of money, the law was clear in my eyes and in the eyes of the court including the Court of Appeals which is now supposed to be hearing my appeal of the criminal conviction.

At this time I am not able to clearly prove all individuals involved, but over the years many threats which I considered at the time to be simply sour grapes seemed to materialize into a criminal investigation, prosecution and conviction. Of course the conviction is now shown to be improper. Given the best interpretation of the facts, the result is highly suspect. It appears likely this was motivated by a desire to destroy my professional career and deprive my clients of an advocate as well as deprive me of my liberty.

The Ryan case is typical of many clients I represented. Although I believe this is the only major criminal trial of my career, I represented hundreds of clients irrespective of whether they could pay me or not. Over the years I billed approximately one million dollars worth of services which were never paid. I employed a staff of several lawyers, legal assistants and secretaries such that we could provide as much service as possible. I seldom sought to enforce collection of these fees, especially if I thought the client simply could not afford to pay.

THOUGHTS ON THE REORGANIZATION OF THE BIG THREE AUTOMAKERS

Chuck Ewing Dublin Ohio 12/01/08

I spent many years as an attorney specializing in reorganizations including Chapter 11 and 12 bankruptcy. The Big Three trauma unfolding across our land is similar to many of the cases I worked on. Much of our country’s problem is systemic, i.e. we have drastically overspent both personally and as a country. The recent mantra repeated throughout the political campaigns that our economic problems are a result of the “failed economic policies of George Bush” while perhaps effective for election may have had an unintended consequence of drastically eroding consumer confidence. When counseling clients in need of reorganization, the first instruction was to stop blaming “others” for the problems and attack the problems of the company in question. In my opinion, the greater cause of our economic problems concerns the fallout from the unexpected September 11, 2001 attack on America, the war in Iraq, the domestic war on terror and incredible natural disaster(s) such as Katrina. In addition, the drastic drain on our wealth, reported to be as much as $700 billion annually, to pay for foreign oil cannot be sustained. The loss of assets and cost of human capital appear to be catastrophic. The loss of wealth to oil must be stemmed or stopped.

The replacement of assets lost is recoverable to a degree because by the process of spending to rebuild, jobs and tax revenue is generated. The loss of human capital due to the deaths and injuries incurred in the 9/11 attacks, the war in Iraq and the natural disasters must simply be absorbed and can likely only be replaced by a new generation.

My limited study of how we rose from the ashes of the 1930’s indicates that government involvement in the Big Three reorganization is necessary and is likely the only means to preserve prosperity for many in our society. My fear is that simply printing more money and giving it to banks and companies without careful control will only prolong the agony. Clients who sought to reorganize outside of the formal Chapter 11 or 12 proceeding almost always failed due to the refusal of one or two of the creditors to agree to the process. The formal proceeding caused all parties including the client to be subject to rigid procedures to restructure. A few of those procedures include assessing the value of secured creditors’ collateral, establishing clear priorities of unsecured creditors, evaluation and/or modification of all executory contracts including leases, compensation, labor contracts and franchises to name a few.

The “Big Three” seek to reorganize and ask for a multi billion dollar bailout, loan or guarantee from the taxpayers. As stated above the government involvement is no doubt necessary. Much talk from supporters of a direct bailout is that millions of jobs would be lost if the companies “go under”, thus we must plow billions into the system immediately to preserve the jobs. If the problem is systemic including poor management decisions, over-reaching labor agreements, impossible luxury care of retirees and a changing demand, simply tossing printed money into the system will only prolong the inevitable. The companies and all associated with them must be jolted into the reality that purchasing habits have changed, there are too many franchises, too many workers, impossible labor costs and other wretched excesses of management spending and compensation. Certainly not all of the causes of the Big Three problems are self inflicted. However, Detroit South seems to be doing much better than Detroit North.

Jobs in the Big Three have already been lost. Some dealer franchises are no longer needed or profitable. Management can no longer spend lavishly or receive multimillion dollar salaries and bonuses. The CEOs looked foolish when they flew their private jets into Washington DC and sat before the committees utterly unaware of how unrealistic their position and requests were. By the same token offering to take $1 per year compensation or driving nine hours to Washington DC is more show and a waste of valuable management time. The managers must be compensated to insure that they have an incentive to make the sacrifice of managing the complicated turnaround of the Big Three companies – not in the millions, but in a reasonable amount to attract and keep quality people.

Suggestions for the reorganization include the following:

1. Each company ought to be judged on its merits. It seems that Ford may not need the drastic measures listed below, although much will depend on the Ford labor pool’s willingness to adapt.

2. Require the filing of a Chapter 11 Reorganization immediately.

3. Be prepared to provide Debtor in Possession financing or guarantees coupled with a Super Priority status as provided in the Bankruptcy Code. This would provide more protection for the taxpayer and perhaps allay the concerns of others who have suffered economic loss through little or no fault of their own, yet are being asked to assume the losses of the Big Three and guarantee their employees a wage and benefit package substantially above other autoworkers and definitely above the wage of the average worker.

4. Look for and if found appoint a trustee or master to supervise the reorganization. (Only from what is seen on television or in print but someone like Mitt Romney, an experienced manager and businessman, is a likely candidate. Along those lines careful oversight of the supervisors is necessary. There is an opportunity for systematic cheating and gouging in the bankruptcy process.)

5. Provide immediate incentive and loosen credit standards for people who own older less efficient cars to purchase the excess inventory reported to be languishing in parking lots across the country. The effect to the cash position of the companies would be immediate and cause less consumption of oil thus lowering the effect of foreign oil purchases. In addition the newer cars would likely cause less pollution. Finally there is a higher likelihood that the funds expended would be recouped.

6. Provide for extended unemployment compensation only if coupled with mandatory retraining for the displaced workers due to the reorganization. Pay for the retraining if necessary.

7. Provide for voluntary buyouts of the displaced franchisees. Many of the displaced sales personnel as well as the mechanics will likely be either absorbed by service institutions performing similar service work or other organizations needing sales persons. It was striking to note the activity in shopping malls surrounding the Apple stores – people were buying.

8. Require a guarantee fund to insure that warranty work will be performed, thus allaying reported concerns that “no one will buy a car from a bankrupt company.” Although the concern is already there since the well publicized demise of the Big Three is already widely reported.

Many concerns have been expressed that there will be economic chaos if the Big Three are not bailed out. I believe it is necessary to jolt the companies, the workers, the franchisees and the American public to avoid the possible chaos of these economic realities. A dramatic response by Americans occurred after 9/11 when we realized that our security and safety were at issue. It is hoped that we could experience a similar dramatic response when the dire reality of necessary reorganization of our system kicks in and that concrete changes in personal and governmental conduct have been adopted to solve the problems. Perhaps it is naïve, but I believe there is a fundamental moral fiber in our society that can rise up and reverse the sad decline of fiscal responsibility both individually and as a society – it will not be easy.

I no longer work on reorganizations but perhaps some of the experience obtained while practicing bankruptcy reorganization of companies can be of assistance in thinking through the problem and providing a rational course of conduct to provide a solution.